LIFE INSURANCE

The lottery is not a retirement plan, and GoFundMe doesn’t equate to a life insurance plan. When we plan for the future, we have an idea or paint a picture of how that looks. If an unexpected event occurs, a proper plan (portfolio) can keep those original plans stay on course. We answer the important questions plaguing your mind and simplify the details, so children can still attend college, the family can remain in place, and even family vacations can still occur. Protection is a key element, but we also discuss living benefits.

What You Need To Know About Life Insurance

- How Much Coverage Do I Need?

The biggest decision you’ll face is how much life coverage you need. The general rule of thumb is that, at a bare minimum, you should provide at least enough to pay off your outstanding debts and cover your funeral expenses. The face value of your policy should cover any remainder on your mortgage and other debts, and provide a cushion to help your family get back on their feet financially after your death. If you have young children, you should also cover your expected annual salary multiplied by the number of years until the youngest is no longer financially dependent.

For more specific answers, see our calculator!

- What Factors Are Considered In Assigning A Premium?

There are a number of factors that may affect how much you pay for your policy aside from the amount of the death benefit you choose. These include your age, your gender, the state of your health and any pre-existing conditions, and whether or not you smoke. Smokers can expect to pay higher premiums than those who don’t use tobacco products.

- Why Should I Buy Life Insurance

If you are the major breadwinner or a major contributor to family income, you should be insured. No one likes to imagine what will happen if they die, but it makes sound financial sense. Potentially, your life insurance benefit can mean the difference between your family keeping the home in which you live and losing it to debt if you are no longer able to provide for them. In general, if you are carrying a mortgage, you should carry at least enough insurance to cover the remaining mortgage so that your heirs aren’t left with an ongoing financial impact.

- What Type Of Life Insurance Do I Need?

Every policy written for you should have a purpose in mind. Examples include mortgage protection or while children are still in the home. Term insurance is for a specific period. Once the replacement needs no longer exist, the policy can either be converted in some instances or fall away. Whole Life insurance is just what it sounds like – your whole life. Permanent insurance has benefits for the insured as well as the beneficiaries. A more flexible option is Universal Life. Which one of these options is determined based on your situation. There is no one size fits all approach.

- What Is A Proper Duration?

The most common reason to purchase life insurance is to replace the household's income if something happens to the insured. While someone is working, the duration would be until they reach retirement age.

Other clients have a large debt or obligation to consider. A life insurance policy could be used to pay off the mortgage. Once the mortgage is paid off, the need no longer exists for the policy. Family businesses that transfer ownership to an adult child could use a policy to ensure the retiring parents receive the income from the business if something were to happen to the new owner.

These are just a few examples of the proper duration of life insurance.

Our Most Recent Life Insurance Blog Articles

Navigating Life Insurance

Life is constantly changing, so even if you have a life insurance plan through your employer, if you were to leave that job, you’d also be leaving behind your life insurance. It’s important to have a personal life insurance policy that is there regardless of your employer. We look at everything from a financial perspective and help you choose a plan and build a portfolio that fits your specific needs.

The following types of life insurance provide you with an overview of just how complex the options can be but with our help, we will help you gain a better understanding so you can be confident that you are choosing the right plan for you.

Term Life Insurance

Term Life insurance is life insurance that you pay for during a specified length of time or term – generally one to 30 years. You select the amount of the death benefit or face amount to meet your needs.

Premiums, or payments, which can be the same amount or increase with time, must be made monthly, quarterly, semi-annually, or annually. If you die during the term of coverage, the face amount of your policy will be paid to your beneficiaries. Term insurance policies do not accumulate cash value and therefore usually offer lower premiums than other life insurance products with the same face value.

Universal Life Insurance

Universal Life is permanent insurance that has the potential to accumulate cash value. However, it offers additional features and options. For example, you can increase or decrease your policy's face amount to accommodate your changing protection needs. You can also increase or decrease the dollar amount of your premium payments and make additional lump sum payments to your policy. Since a Universal Life policy accrues cash value, you can borrow against this cash value for any purpose.

You have the option to skip premium payments if your account has accrued sufficient value because the premiums will be taken from the accrued value. A Universal Life policy also has the potential to earn a higher rate of return than a whole life policy, although there is a risk that your rate of return could drop.

Whole Life Insurance

Whole Life Insurance is life insurance that you own for your entire lifetime. The amount of the death benefit or face amount can be selected to meet your needs.

Premiums, or payments, are fixed and can be paid monthly, quarterly, semi-annually, or annually. As more premiums are paid, your policy accumulates a cash value that grows on a tax deferred basis. In essence, whole life is like buying a house versus renting it. The monthly cost is higher than it would be for a term life policy, but with each payment you make you gain equity. You can borrow against a Whole Life policy for any purpose. Loans, however, require you to pay interest and any borrowed amount you do not pay back is deducted from the payout to your beneficiary at the time of your death.

Final Expense Insurance

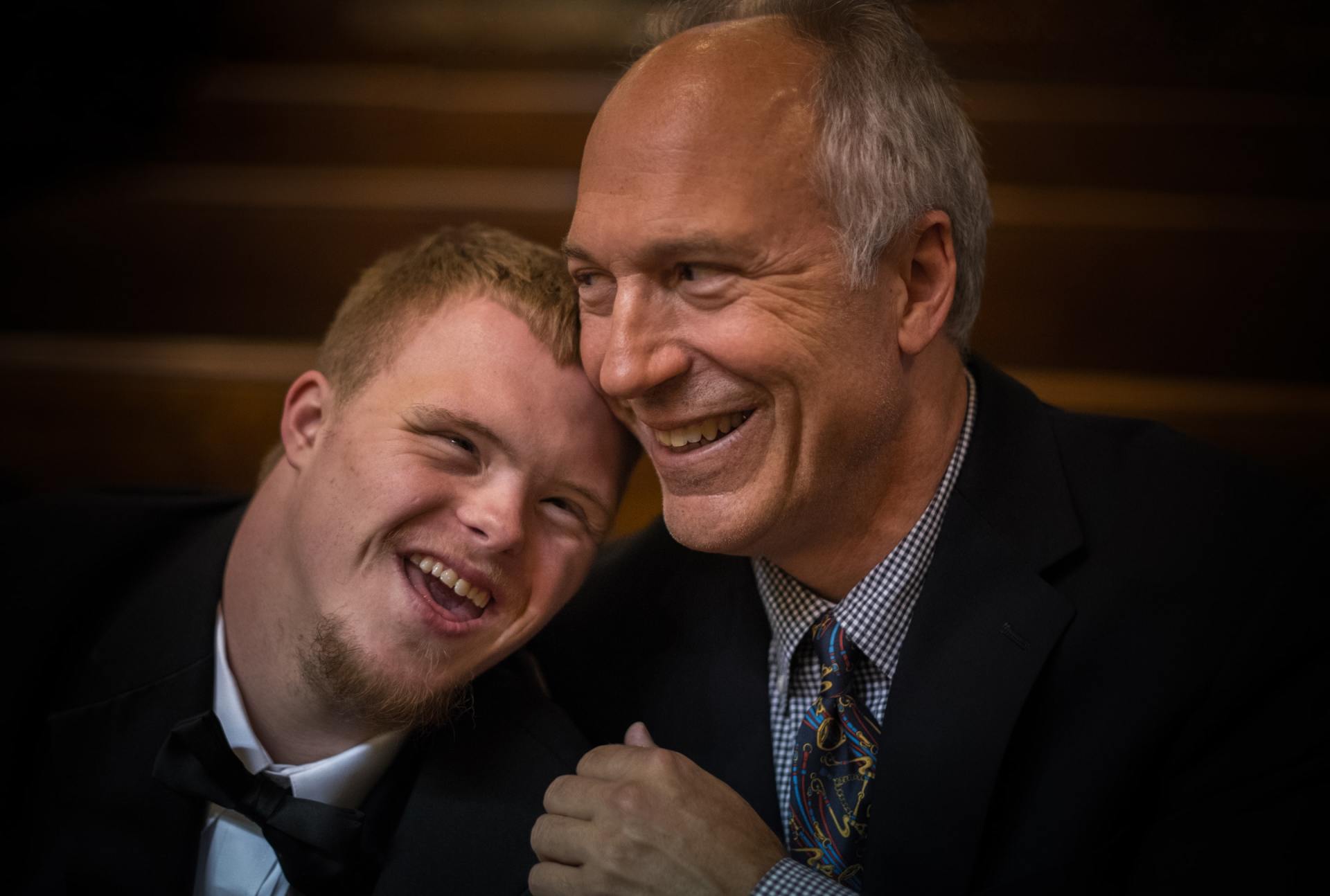

Your family means the world to you. The last thing you want is to leave them with major expenses after you’re gone. Final Expense insurance is life insurance that helps provide the money they may need to pay medical bills, funeral expenses, legal fees or unpaid bills. It is an insurance policy that lets you decide how your assets are distributed. By planning ahead, you can help protect your loved ones from unnecessary financial stress when you die. And, you can distribute your assets in the manner you decide!

Tips To Help You Save Money on Life Insurance

- Only buy what you need

- Get the most appropriate coverage for a mortgage

READY TO GET STARTED?

It all starts with a conversation.

Join Our Newsletter

We will get back to you as soon as possible.

Please try again later.